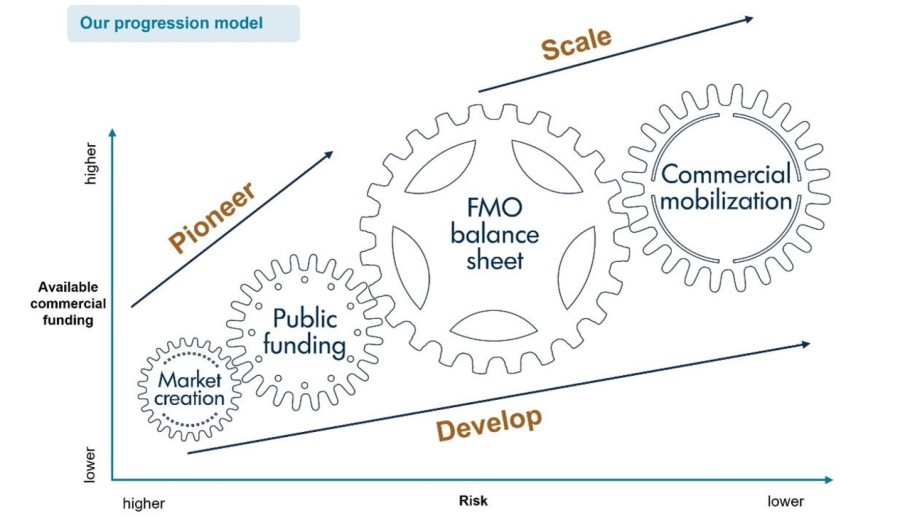

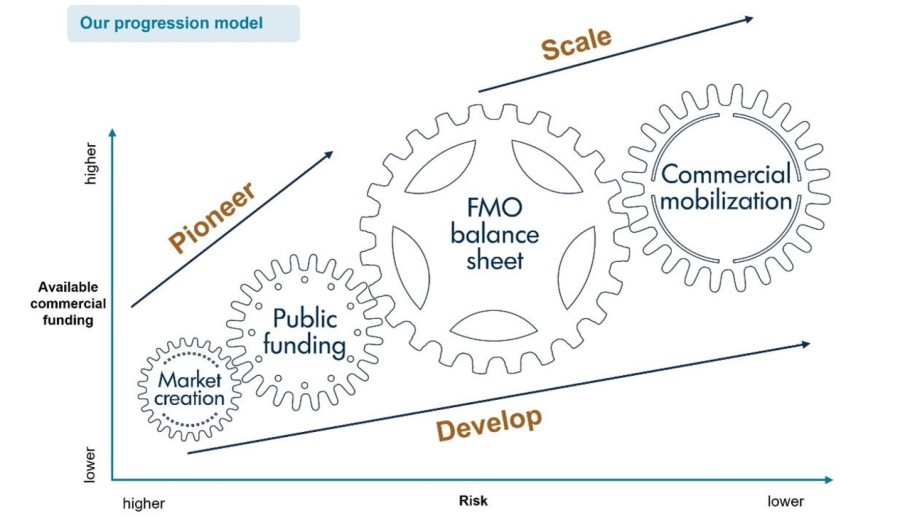

What is the progression model?

The progression model outlines our long-term commitment to our customers, supporting the growth of their business with four different funding steps. Throughout this journey, we provide technical assistance and enhance capabilities on environmental, social, and governance (ESG) topics.

- The model starts with market creation, providing support for early-stage businesses to become viable and investment-ready projects for development finance institutions and other impact investors.

- The second phase is through our public funds, high-risk loans funded by public sources to help businesses develop further.

- As companies develop, they can receive funding from FMO’s own balance sheet, financing for more established companies.

- The fourth and final step is attracting commercial investors to co-invest alongside FMO in its customers.

With each step, businesses grow stronger, and investment risks decrease as they expand and enhance their governance structures, as well as their environmental and social standards.

Understanding progression

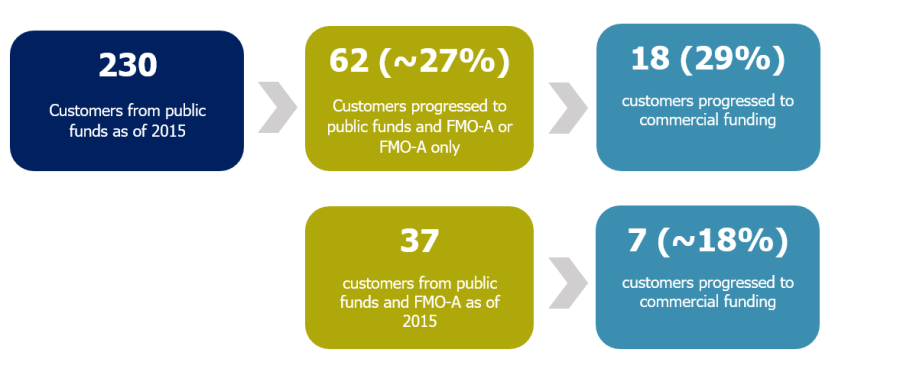

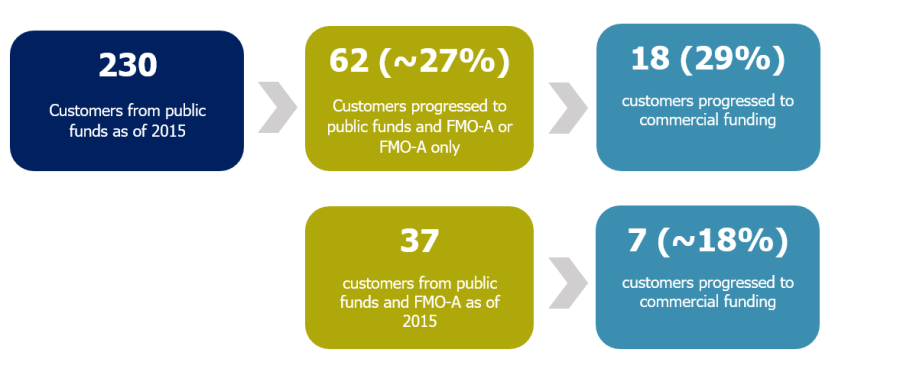

To understand how well the progression model works in practice, we hired Dalberg, an independent advisory firm, to evaluate it. The study focused on customers who entered our model via the Dutch public funds Access to Energy Fund, Building Prospects and MASSIF between 2006 and 2015, analyzing their movement within the framework. It used internal data sources, excluding customers who received commercial funding not mobilized by FMO. The analysis did not assess the overall progression of entire sectors or markets due to FMO’s involvement. The findings revealed that:

- 27% of companies (62 out of 230) that initially received public funding progressed to our balance sheet financing.

- 29% of those (18 companies) advanced further to secure commercial funding.

- 18% of the 37 customers with a blend of public funds and FMO's balance sheet progressed to commercial funding.

- Customers engaged in green business practices exhibited stronger progression rates.

- Progression was notably higher in Asian markets and within the banking sector.

Dalberg's assessment confirmed that businesses move through the different financing stages FMO offers. The evaluation also highlighted that FMO’s overall investment strategy, financial products, and additional support—such as technical assistance and ESG support—play a key role in helping businesses grow and progress through the model. According to Dalberg, FMO is the first European Development Finance Institution (DFIs) they’ve worked with that now has this information. Comparable data for benchmarking across DFIs is not yet easily available.

Key factors influencing progression

A key goal of this evaluation was to identify what drives customer progression. Dalberg found that three main factors shape this journey:

- Market-based factors: Economic and socio-political stability, along with sector maturity, are crucial in determining whether businesses can transition to commercial financing.

- Company-specific factors: A strong track record, high-quality governance, and a commitment to sustainable business practices significantly increase a company’s chances of progressing.

- FMO-driven factors: Our investment strategy, financial structuring, and support services—such as ESG advisory and technical assistance—play a vital role in helping businesses grow and advance.

How can we influence progression?

One of the most important insights from this evaluation is the impact of non-financial services in supporting business growth and attracting investment. These services include:

- Strategic support and networks – Backed by patient capital, we provide businesses with the connections and long-term guidance they need to scale.

- Technical assistance and capacity development – Strengthening governance, improving environmental & social (E&S) systems, and adopting greener practices make businesses more attractive to Development Finance Institutions (DFIs) and impact investors, key funders in high-risk markets.

- Market-level action – Driving sector-wide progress by setting standards in areas like credit ratings and ESG performance. Stronger industry benchmarks help businesses mature and move up the value chain.

This evaluation confirms that progression is real, measurable, and can be actively influenced by promoting sustainable business practices. As a development bank, we remain committed to championing green and responsible business operations as a key driver of long-term commercial success.

Strategic recommendations and our response

The evaluation put forth four key recommendations to strengthen our approach:

- Clarify the contribution of progression to business priorities: → We reaffirm that the progression model is integral to our 2030 strategy and impact ambitions, not an end goal in itself. It serves as a vehicle for scaling sustainable business growth and economic development.

- Define how the model can steer fund-level actions and priorities. → We recognize the importance of raising awareness around progression-enabling initiatives, particularly the role of public funding, ESG improvements, and technical assistance in fostering sustainable growth.

- Establish a Measurement, Evaluation, and Learning (MEL) strategy for progression→ While we view progression as essential to impact, it is not an isolated metric. It is embedded within our broader Theory of Change and MEL framework to ensure that impact measurement remains holistic and outcome-driven.

- Advocate for progression supporting initiatives in FMO's mix of financial instruments, risk-sharing options, and non-financial support (like technical assistance and ESG advice). → We believe that the development finance architecture would indeed benefit from an improved understanding of best practices that accelerate progression. Most importantly, we believe that we, as DFIs, must avoid practices that slow down progression, such as investing concessional resources in ways that keep customers reliant on concessional terms for too long.

FMO's complete response to the recommendations is available in the Downloads section