Microfinance Ratings and Client Protection Principles: What Use are They to Investors?

Any party investing in microfinance todaymust ensure that investments satisfy certain market standards around “responsible” finance. Respecting and promoting client protection is an important part of this. Inhe Smart Campaign coined seven Client Protection Principles (CPPs). The main points of these are responsible business models (in other words, not based on high delinquency or high interest rates), ensuring that clients are borrowing within their means, transparent towards clients, ensuring privacy of client data, designing the right products for clients and respectful treatment of clients. In 2013 the Smart Campaign entrusted four rating agencies to begin certifying microfinance institutions that meet high standards in all these areas. To date, 29 organizations have been certified.

Attendees of this workshop will go through various case studies exploring the seven CPPs and the dilemmas sometimes faced as an investor or potential investor. The four rating agencies presenting will also present their products: CPP certification, social rating and MFI rating.

Presenters

- Alok Misra, M-CRIL

- Aldo Moauro, Microfinanza

- Damian Von Stauffenberg, MicroRate

- Edouard Sers, Planet Rating

Workshop Objectives

- Provide an overview of ratings products available to investors, particularly the Microfinance Institutional Rating and the Social Rating

- Explain the complementarities between ratings products and Client Protection Certification

- Review and discuss case studies, particularly focusing on Client Protection Principles, that demonstrate how investors can use ratings in their due diligence and monitoring.

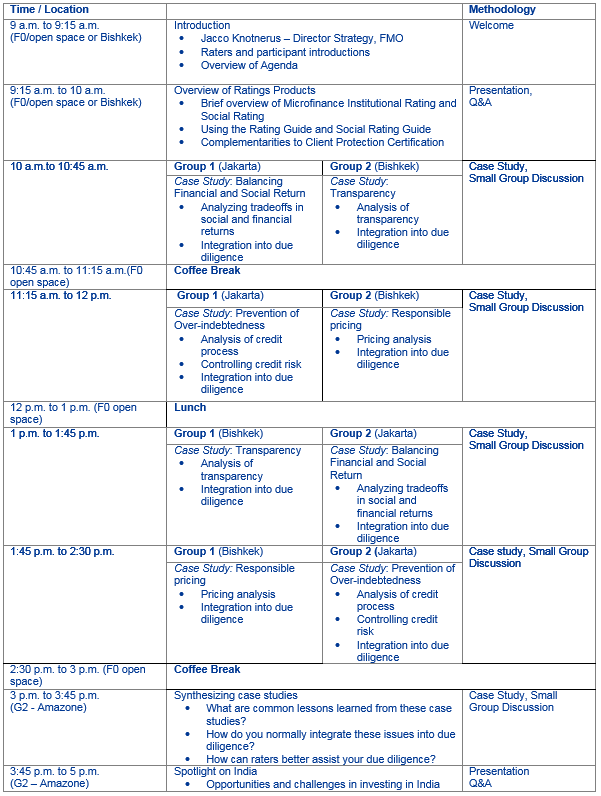

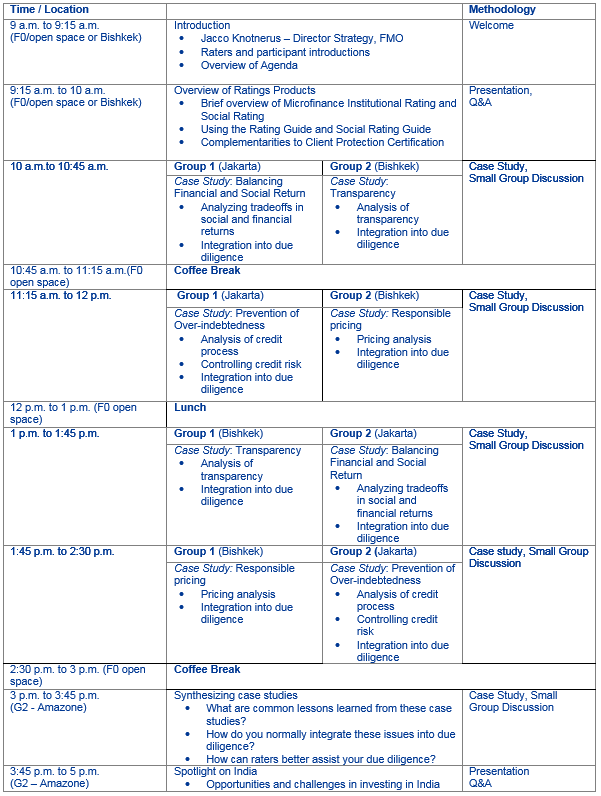

Program