Issuer FMO ("NEDFIN")

Ratings AA+ S&P (stable) / AAA Fitch (stable)

Size USD 300 million

Coupon 3m USD Libor plus 8 bps

Format Floating rate note / RegS

Issue date 17 February 2015

Maturity date 24 August 2016

Tenor 1.5 years

Re-offer price 100.0%

Denomination USD 1k

ISIN XS1193940829

Joint-Bookrunners JP Morgan and the Royal Bank of Scotland

On Tuesday, 17 February 2015, the Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), the Dutch development bank, issued a new $300m RegS 18‐month floating rate note due 24 August 2016. The issuance spread was fixed at 3m USD Libor +8bps, giving a re-offer price of par.

J.P. Morgan and the Royal Bank of Scotland acted as lead managers.

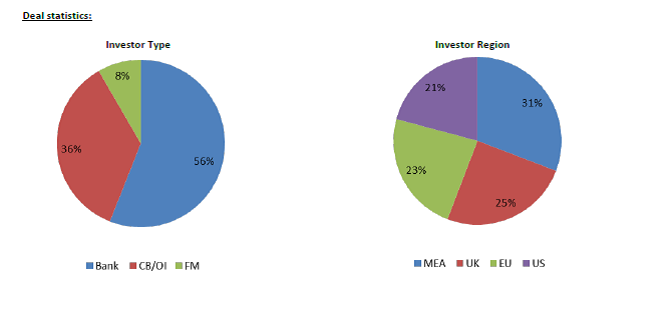

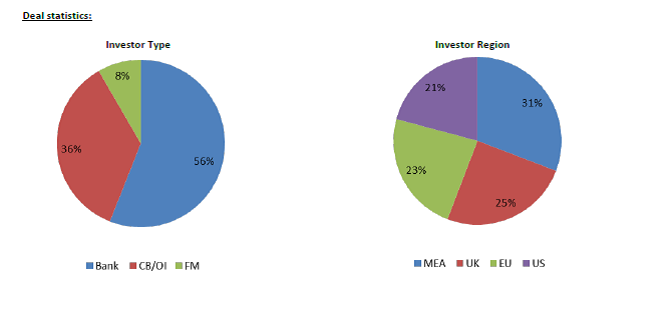

The issuance attracted good demand across a variety of investors, producing an oversubscribed order book for this $300m no grow transaction. With a U.S. holiday on Monday 16 February, FMO utilised the window prior to the beginning of Chinese New Year to launch their first Dollar transaction of 2015 – a new floating rate note issued on Tuesday 17 February. Books on the transaction were opened at 09.20am CET on the morning of Tuesday 17 with a spread of 3m USD Libor +8bps.

The order book grew during the European morning and was kept open through to the U. S. morning to allow for accounts in the Americas to look at this transaction. Books closed at 10.00am NY time / 16.00 CET with an oversubscribed order book.

FMO has a funding need in 2015 of EUR 1.0-1.5 billion.

About FMO

FMO (the Netherlands Development Finance Company) is the Dutch development bank. FMO supports sustainable private sector growth in developing and emerging markets by investing in ambitious entrepreneurs. FMO believes a strong private sector leads to economic and social development, empowering people to employ their skills and improve their quality of life. FMO is 51% government owned, with strong government support via its support agreement with the Dutch state.

For further details please contact:

Huib-Jan de Ruijter (Financial Markets Director) Tel: +31 70 3149531; E-mail: h.de.ruijter@fmo.nl

Arthur Leijgraaff (Senior Treasury Officer) Tel: +31 70 3149852; E-mail: a.leijgraaff@fmo.nl