In 2023, FMO’s investment portfolio supported around 990 thousand direct and indirect jobs in local markets and enhanced access to energy, food and finance, all crucial factors in breaking the downward cycle of poverty and migration.Over the next decade, the World Bank estimates one billion young people — a majority living in emerging markets — will try to enter the job market. If they won’t be able to find decent jobs, this will leave millions without hope for a good future.

Last year, the volatile global economic and geo-political circumstances were aggravated by more extreme weather conditions, food crises, the collapse of several major banks, the ongoing war in Ukraine, the war in Gaza, and Sahel coups. All with direct and prolonged devastating effects on the well-being of entire communities, in particular in FMO’s geographies. This instability is often worsened by adverse financial factors in many emerging markets such as higher interest rates, high inflations, and increased sovereign debt. Achieving the UN sustainability Goals by 2030 – only six years away – is in serious danger of getting out of sight.

Within this context, FMO’s 50+ year mission becomes more relevant by the day: enabling entrepreneurs to increase inclusive and sustainable prosperity.

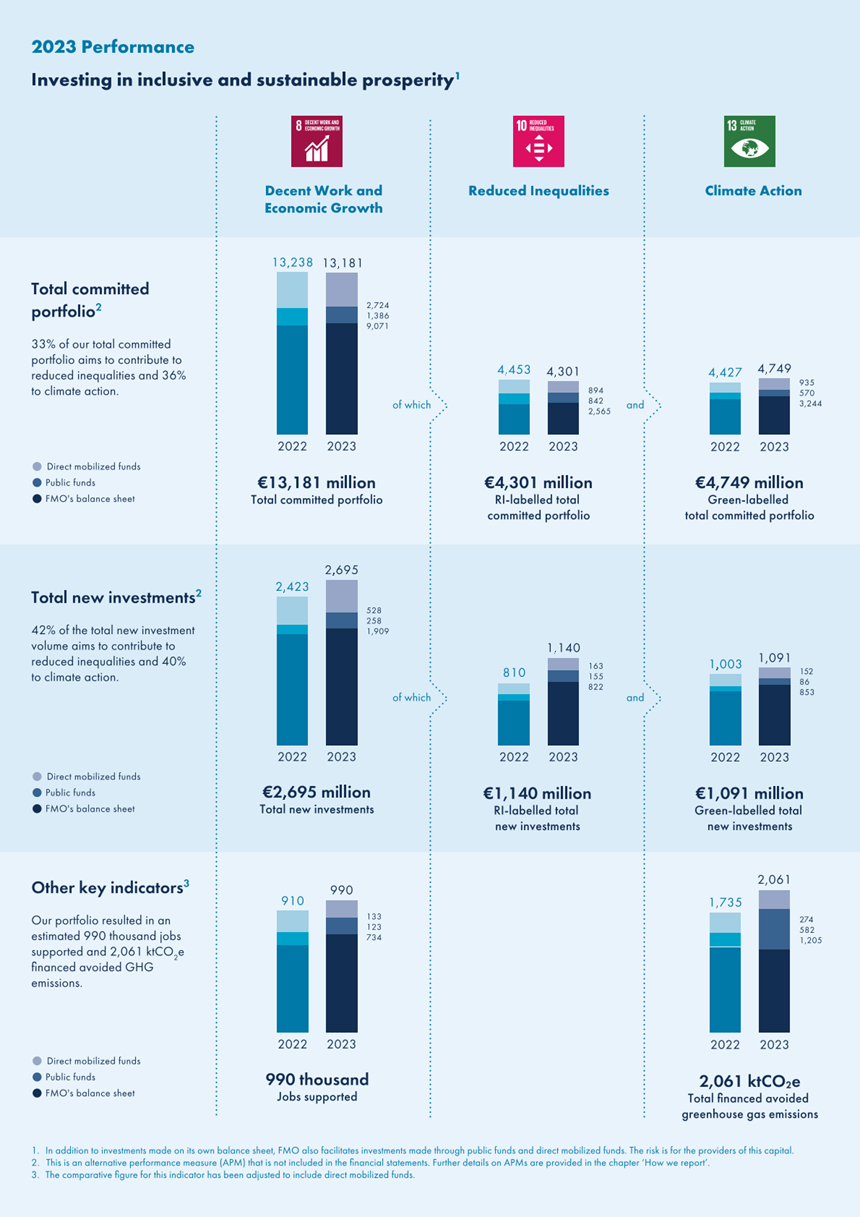

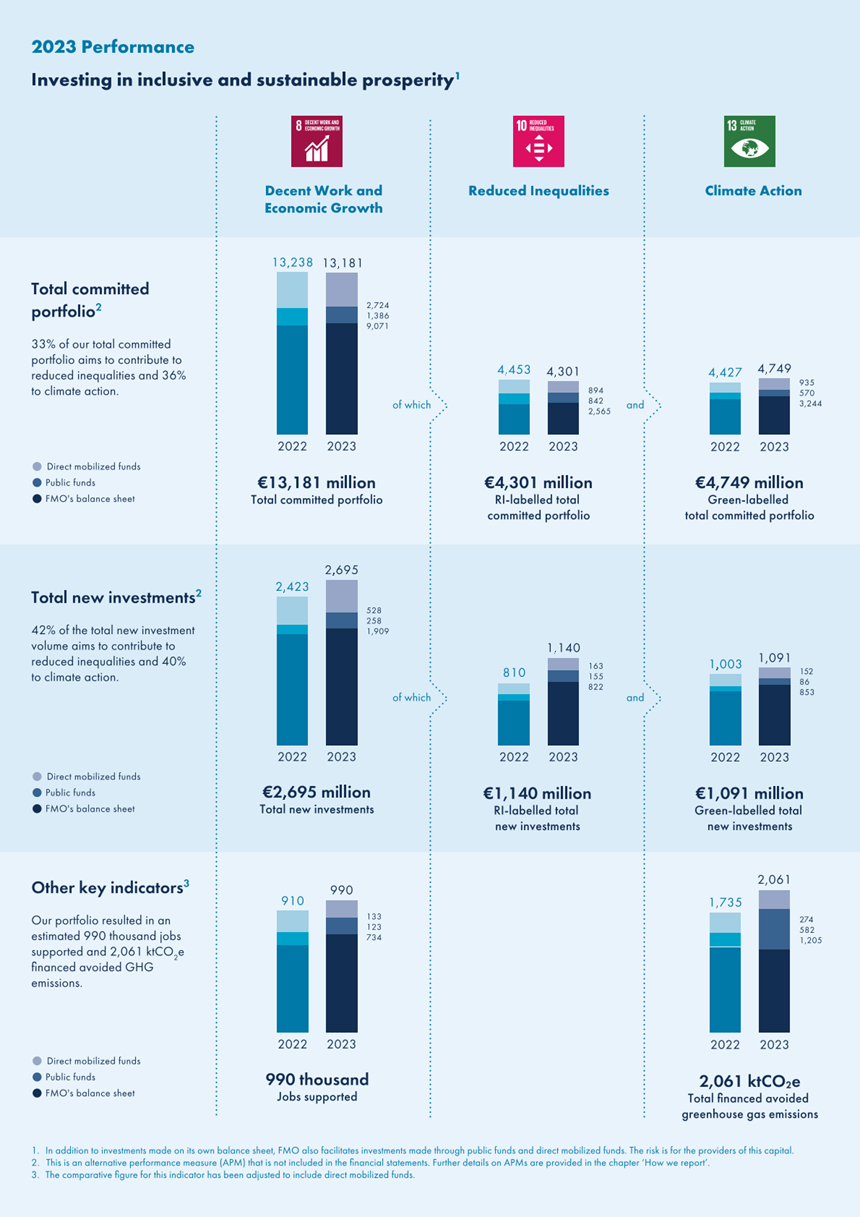

Impact, profit and new investments

In 2023 FMO made €2.7 billion worth of total new investments (2022: €2.4 billion). Of this, €1,140 million carried the label ‘reducing inequalities’, a strong increase in challenging global circumstances (2022: €810 million). Contributing to climate action, Green-labelled total new investments were made worth €1,091 million (2022: €1,003 million). At €13.2 billion, our total committed portfolio remained roughly the same as last year due to the level of loan repayments and exits in our portfolio as well as the negative effects of the EUR/USD exchange rate.

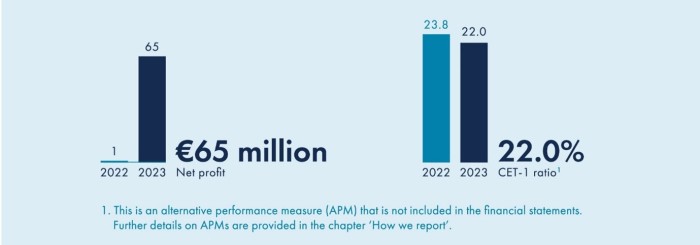

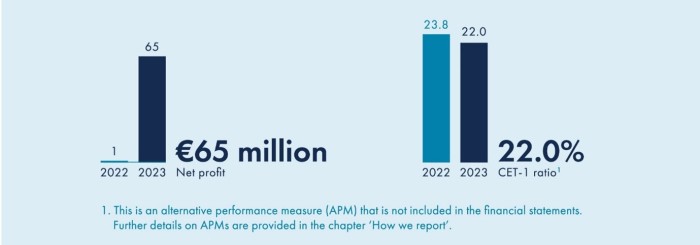

Over the year 2023, our net profit amounted to €65 million (2022: €1 million). A large share of FMO’s investment and funding portfolios are denominated in US Dollars. The overall trend in the EUR/USD exchange rate had a negative impact on our net profit due to foreign exchange losses recorded on our investment portfolio. Looking at our regular income, based primarily on dividend and interest payments, we were well in balance with our operating expenses. Loan provisions were materially lower than last year, then largely impacted by exposures in Ukraine, Sri Lanka, and Myanmar. The non-performing exposures ratio decreased to 9.8 percent (2022: 11.9 percent). The common equity tier 1 (CET-1) ratio was 22.0 percent (2022: 23.8 percent). Combined with our impact results, these are positive numbers in a highly volatile environment.

The SDG Loan Fund and Market Creation

We were grateful to see the recognition at and after COP28 of the SDG Loan Fund, an innovation widely praised as a leading example regarding the mobilization of private capital. The fund unlocks around US$1 billion of institutional capital towards the SDGs through a unique blended finance cooperation, set up by Allianz, MacArthur Foundation, and FMO. We hope and expect other institutional investors, DFIs, and foundations to replicate this initiative, contributing to an impact that would otherwise not be possible.

Fostering the new generation of entrepreneurs in emerging markets, in 2023 we started building a new pillar within FMO, focused on Market Creation. Our aim is to help upcoming sustainable businesses grow to the level where they can absorb regular funding, first from us and ultimately from institutional investors. This will allow them to contribute to job creation, local prosperity, and climate action on a larger scale. By providing technical assistance and investment partners, we will support the development of these currently unbankable, yet potentially impactful opportunities, into bankable and scalable businesses, starting in Africa.

World Class Workplace

To increase our impact and meet the expectations of our stakeholders, we continued to strengthen and streamline our organization. The recruitment of new colleagues progressed well despite a challenging labor market, and we prioritized employee wellbeing and engagement. The classification of FMO as a ‘World Class Workplace’ by Effectory, which conducted our bi-annual employee engagement survey, reflects the improved engagement levels and work satisfaction. Our employees are proud of our vision and goals, as well as the atmosphere and trust within their team. Efficiency remains the most important area for improvement and is high on our agenda.

Underpinning our goal to be a transparent reporter, we were pleased to secure a second place in the Transparency Benchmark 2023. This government-led, bi-annual study measures transparency in reporting on corporate social responsibility amongst the largest companies in the Netherlands.

Increase new investments

Staying the course, in 2024 we will focus on the same priorities as in 2023, continuing our work towards the goals in our Strategy 2030. We aim to further increase new investments in Green and Reduced Inequalities and will take the next steps in market creation.

Michael Jongeneel, CEO of FMO: ‘‘With the immense challenge in geopolitical stability and climate change ahead, FMO keeps working with entrepreneurs and other partners to create jobs and support the overall economic development in emerging markets. We see it as our role to be countercyclical and focus on the long term. We invest when others shy away, always with our mission in mind: enabling entrepreneurs to increase inclusive and sustainable prosperity.’’

For more information, please see the annual report: FMO | annual and interim reports