FMO has changed the way it measures the number of jobs that are supported by our customers. As a result the number of jobs FMO supported in the first half of 2020 is 35 percent lower compared to the end of 2019.

FMO will replace its current tool to measure jobs supported by a new methodology: the Joint Impact Model (JIM). Creating the model was a collaboration between consultancy firm Steward Redqueen, Proparco, CDC, AfDB, BIO, FinDev Canada, and FMO. The new methodology will be accessible for all development banks and impact investors who wish to use it: a big step forward in harmonizing impact measurement.

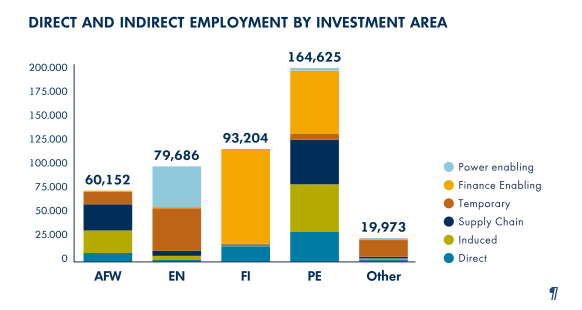

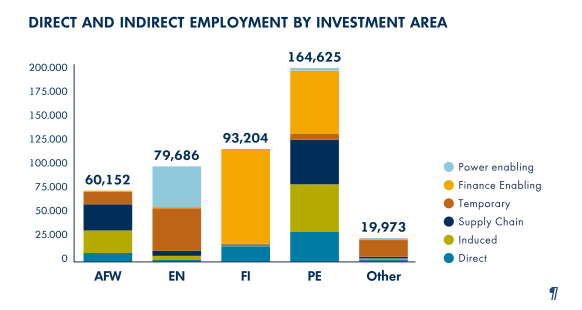

In absolute numbers, the Joint Impact Model leads to lower estimated jobs, as the future effects are no longer calculated. This is visible for the first time in the interim report for 2020. With 417,639 direct and indirect jobs supported, the number is 35 percent lower than we reported at the end of 2019. As a different methodology is used, we will no longer use the results of the previous Impact Model for comparison or benchmarking purposes.

SDG 8

The creation of decent jobs is imperative to reducing poverty and improving quality of life in developing countries. Encouraging entrepreneurship and supporting jobs is therefore part of the UN sustainable development goals (SDG 8) and is - alongside reducing inequality and climate action - top priority for FMO when making investment decisions.

|

Changes to the methodology

The most important change for FMO brought forward by the new Joint Impact Model is its ability to run at portfolio level instead of at commitment. This means that we are no longer estimating the expected effects in the future (ex-ante) but focus on what is in our current outstanding portfolio (ex-post). For example, we no longer base estimations on power plants built in the future, or on the expected impact of investees in private equity funds. Instead, we base them on what has already been built, and take into account the current investees of the private equity funds we invest in.

In addition, we changed several assumptions that are applied by the model. The most important ones are as follows:

- The Joint Impact Model includes new macroeconomic information and will include latest available data to be up to date.

- More detailed information is used on sector level, which allows FMO to have better estimates and insights on investments made in our focus sectors, especially energy and financial institutions. For example, over eighty thousand firms and over eleven countries were studied to provide better estimates on the effects of financial institutions and additional renewable energy on the wider economy.

- A new attribution approach has been applied to private equity investments: the times 2 multiplier is no longer applied and we divide our investments by total assets instead of non-current assets. As equity investments make up a large portion of our portfolio, this has had a significant impact on the number of indirect jobs supported. Meanwhile, the working group behind the JIM will conduct research to find the right multiplier to apply to private equity investments that is backed by evidence.

We believe the Joint Impact Model is now the best estimate available for measuring jobs supported, given the data availability of our customers, and existing data banks. Measuring jobs at portfolio level is also in line with how we measure impact on our other priorities - green and reducing inequality. Furthermore, this method is more robust, as it relies on more detailed and current data, instead of on projections.

JIM provides more detailed information on sector level

Each investment area shows different effects. For example, in Financial Institutions, impact is mainly driven by finance enabling effects. These are economy-wide jobs generated via financial services due to lending to businesses and individuals. Direct employment is also a strong driver for Financial Institutions as they are one of the biggest direct employers. In Energy, impact is mainly driven by power enabling effects, which attributes the number of jobs as a result of an increase in gigawatt hours (GWh) of electricity supplied to the national system. It also has very high temporary effects, which is due to the number of projects that are currently in construction phase. In Agribusiness, Food & Water, the split is distributed more evenly across supply chain effects related to the impact that stem from sourcing goods and services from producers, and Induced effects that stem from re-spending wages into the economy. Private Equity consists of corporates, funds, energy projects and financial institutions. Their impact stems from power enabling, finance enabling and induced/supply Chain effects, reflecting the wide-ranging activities that Private Equity engages in.

|

Harmonizing methodologies

The Joint Impact Model replaces the former Impact Model. This model was tailored specifically for FMO by Steward Redqueen, a consultancy firm specialized in impact and sustainability. FMO estimated the future (ex-ante) effects of our loans and investments on jobs supported in line with our ambition in 2015 to double our impact and half our footprint by 2020. We needed to know the future impact of new commitments, not the impact of our total outstanding portfolio.

Over the years other development finance institutions (DFIs) started using similar methodologies. Although the fundamentals used in these impact models are the same (input-output model), decisions on assumptions and the implementation of the model differed significantly, making results incomparable.

In January 2019, Proparco, CDC and FMO agreed to harmonize their methodologies on indirect jobs, using again the services of Steward Redqueen. This required aligning the methodologies, underlying macro data and client data used to run the new Joint Impact Model. Now, a year and a half later, the model will soon be made open access, making it accessible for all development banks and impact investors that wish to use the methodology. A big step forward in harmonizing impact measurement.

Estimation of the real world

We are proud to be part of the creation of the Joint Impact Model and the harmonisation it offers to Development Finance Institutions (DFIs) and Mulitlateral Development Banks (MDBs). Still it is important to note that it is used for estimating economy-wide effects - using the latest ILO and World Bank data – and remains an estimation of the real world.

Recent impacts from COVID-19 and other worldwide crises are considered but with a delay due to the macroeconomic data falling a few years behind. A working group will be exploring how to use the Joint Impact Model to provide insights into the most efficient sectors to invest in so as to tackle unemployment. Identifying these key sectors may help to balance out the negative impacts of COVID-19.

The model is a work in progress. We expect the underlying numbers to change as we test with partners - currently there are 15 DFIs, MBDs, and other private investors -, add studies and find more ways to harmonize and agree on methodologies, as well as improve our data collection methods.

More information on the model and the underlying assumptions is available on our public website: Joint Impact Model.