This fund allows for investments in projects aimed at climate adaptation and prevention in developing countries.

Climate change poses an unprecedented threat to humanity in the 21st century. In the period up to 2030, an estimated $3.5 trillion is required for developing countries to implement the Paris climate pledges to prevent potentially catastrophic and irreversible effects of climate change.

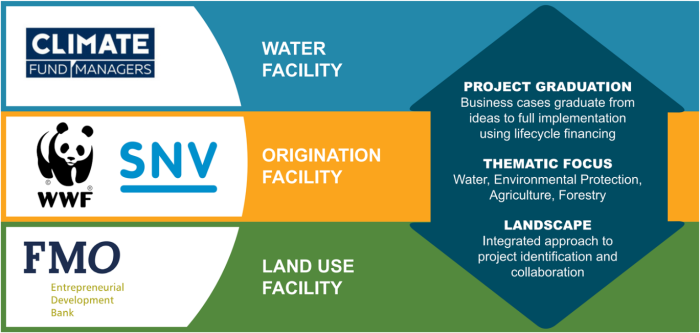

With notable shortfalls in funding and a dominant focus on climate mitigation by global financing parties to date, Dutch development bank FMO has partnered with SNV Netherlands Development Organisation (SNV), World Wide Fund for Nature (WWF-NL) and Climate Fund Managers (CFM) to manage the Dutch Fund for Climate and Development (DFCD) on behalf of the Dutch Ministry of Foreign Affairs.

The fund seeks to improve the wellbeing, economic prospects, and livelihoods of vulnerable groups – particularly women and youth – and enhance the health of critical ecosystems, from river basins to tropical rainforests, marshland, and mangroves. The consortium’s activities will also help protect communities and cities from the increasing frequency of extreme weather events and benefit weakening biodiversity in areas that provide people with water, food, medicine, and economic opportunity.

The consortium aims to establish a fund that can serve as a global example for attracting and deploying public and private capital in well-designed and impactful climate-relevant projects, in particular for climate adaptation. The partners will connect the long-standing project development expertise of SNV and WWF to the mobilizing and investment power of FMO and CFM. This will allow projects to graduate from idea to full implementation, using lifecycle financing for every stage.

Furthermore, the consortium will adopt a ‘landscape’ strategy for deal origination and execution. This strategy allows consortium parties to actively source and develop investment opportunities for other consortium parties in-and-around, in the vicinity of, as well as downstream from, their own investment activities.

The fund will be focusing on several high impact investment themes, including climate-resilient water systems and freshwater ecosystems, forestry, climate-smart agriculture, and restoration of ecosystems to protect the environment.

The fund will be structured with three separate but operationally linked facilities, each with a specific sub-sector focus and role across the project lifecycle.

For more information on the DFCD, please visit: https://thedfcd.com/